Estates, Wills & Trusts

It’s never too early to start your estate planning, and there’s no better time to start than today. You may have been putting off making a Will for a while now, or maybe an update to your last Will is long overdue.

Most of us would rather not think about needing a Living Will or a Will, but it is important to overcome that. Preparing for incapacity or death is an obligation that you have to your family.

Estate Planning is for Everyone

Making a Will and an estate plan is not just for the elderly or wealthy. Whatever your stage of life, you can experience the peace of mind that comes from knowing that you’ve taken action to carry out your wishes and take care of your family. Good planning can help ensure that your legacy will be protected, fairly distributed, and handled smoothly without any complications.

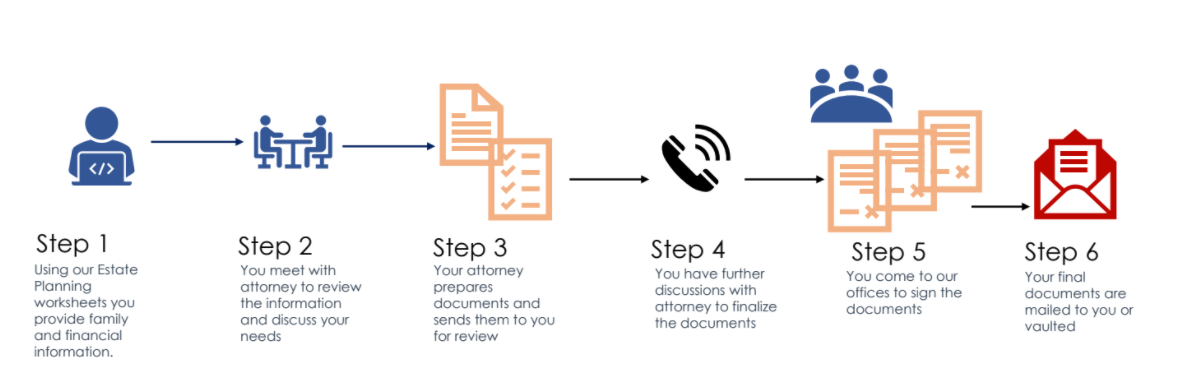

Our Process

Program Options

Option 1 - Estate Planning Essentials (PA) - fixed fee package

We help you make a Will, Power of Attorney, and Living Will/Healthcare Power of Attorney.

Our approach combines:

personalized planning with an estate planning attorney

fixed price

You can enroll online and complete the entire process with the assurance of transparent pricing. Meetings can be in-person or by phone or video-conference, as you prefer (other than the in-person Will and Power of Attorney signing.)

Option 2 - Traditional Estate Planning Process - hourly rates

The process begins by answering a few simple questions. We’ll give you Worksheets for you to tell about you and your family. You can use our practical guides to make decisions about the people who will have a role in your estate planning documents and how your assets are distributed. We’ll also help you make a list of your property and other assets.

Estate Planning from Start to Finish

The process begins by answering a few simple questions. We’ll give you Worksheets for you to tell about you and your family. You can use our practical guides to make decisions about the people who will have a role in your estate planning documents and how your assets are distributed. We’ll also help you make a list of your property and other assets.

We’ll meet together and come up with a plan for who you want to receive your assets in the event of your death and how to set in place the proper measures to ensure that your assets are protected. If you have minor children or family members who depend on you, there is also the non-financial side of estate planning, which can involve choosing guardians and trustees.

An estate plan can include Wills, Trusts, Powers of Attorney, Living Wills, and a wide spectrum of legal devices to make the estate plan as comprehensive and efficient as possible.

Keeping An Estate Plan Up-To-Date

Since your assets and relationships will certainly change over time, it is important to keep your estate plan up-to-date to ensure it is still relevant. If you don’t have a well-crafted, current estate plan, it can result in:

Large estate taxes

Wills being contested

Assets not being distributed as intended

The best way to protect your family and legacy is to have a solid, up-to-date estate plan.

“The best time to plant a tree was 20 years ago. The second best time is now”